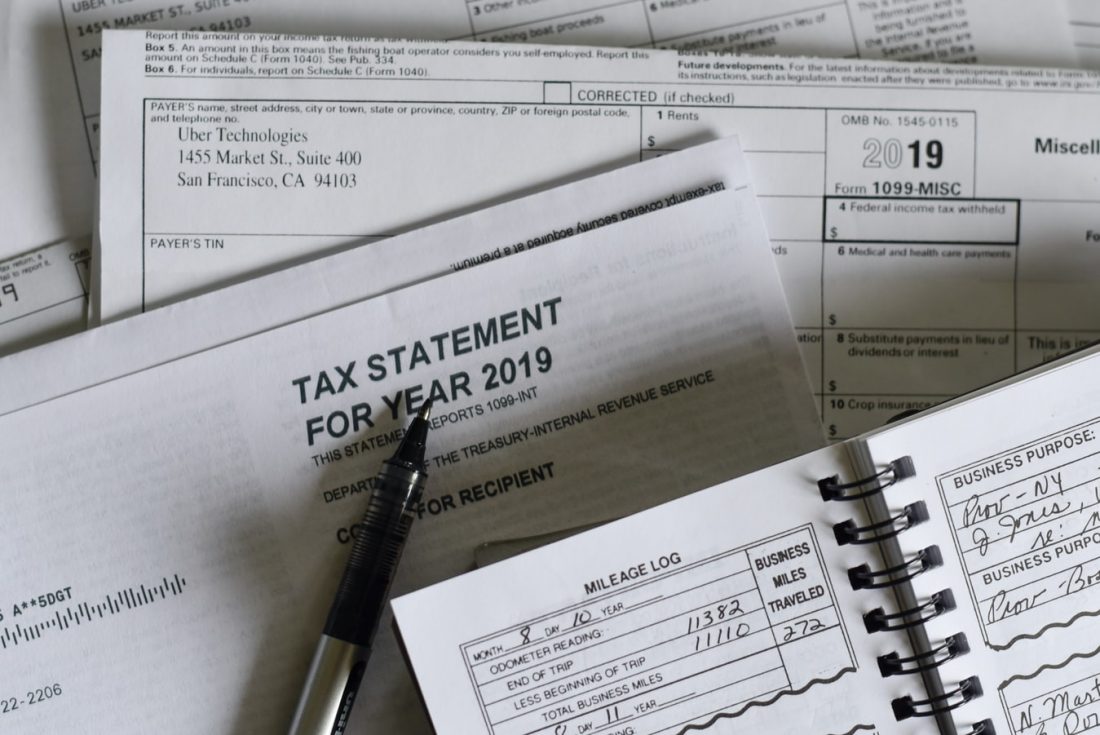

If you get a tax notice from the IRS but don’t have the money to pay the bill, you need not panic as you can utilize several available tax relief services. The IRS presents multiple options for tax relief that you can explore.

Tax relief permits you to reduce the tax amount you need to pay or to split your debt owed into smaller, manageable payments. Tax relief will not remove your amount owed, in fact it could increase your costs over the long run, but it can make your tax management easier.

What is meant by Tax Relief?

To clarify, tax relief means negotiating a plan with IRS agents or arranging a plan for payment. It will not erase your tax amount obligation but makes it easier for you to handle your owed tax debt.

Victims of emergencies and natural disasters like wildfires and hurricanes can try to get special relief. They can apply to extend their deadline for payment and also apply for claiming casualty losses in their IRS tax returns.

Tax Relief Firms

Tax relief firms use TV, radio and the web to advertise the services they provide to needful taxpayers. They can negotiate with IRS agents about your case – for a charge. The tax relief firm can talk to the IRS to work out a compromise, or a plan for interest or penalty reduction, or an installment agreement.

Ensure to do your homework and select a qualified and reputable tax expert. The FTC (Federal Trade Commission) stipulates that only the following tax professionals can represent a taxpayer before the IRS:

- Attorneys

- CPAs (Certified Public Accountants)

- Enrolled agents (these are tax practitioners who are federally authorized to present taxpayers’ cases before IRS officials).

When recruiting a tax professional or firm to represent your case, watch out for default billing charges that may be applicable even if you cancel, negative refund policies and high upfront charges. Meet the tax expert in person and get an explanation of your options as well as the firm’s fees before you sign with them or pay anything.

Tax Relief Options

Consider the following tax relief options to manage your tax debt:

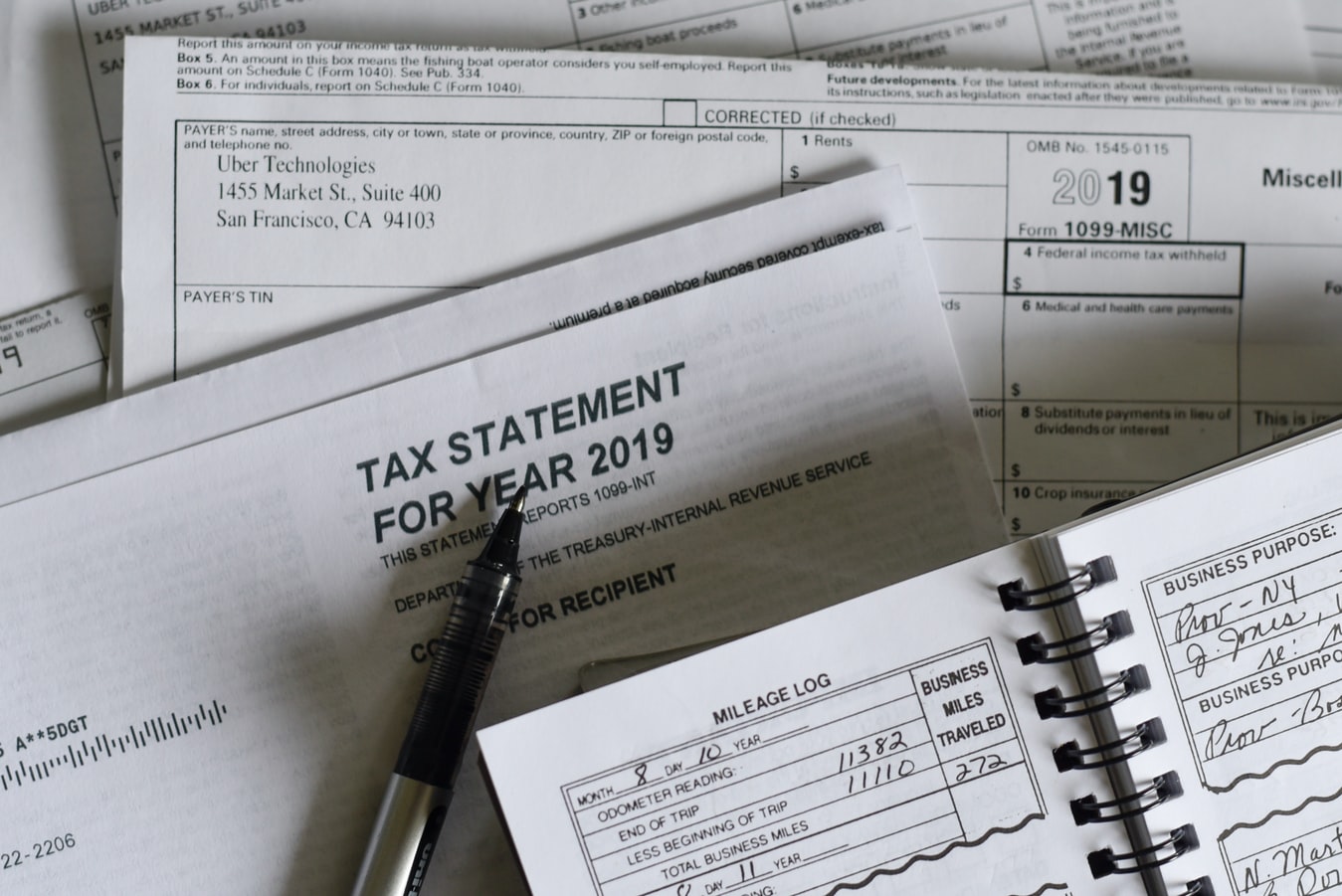

IRS Repayment Package

The IRS can permit you to split your tax balance into easier smaller payments. For a long-term plan of 4 or more months, your owed amount should be less than $50,000 in taxes, interest and penalties combined. To qualify for a shorter term plan of less than 4 months, your tax balance can be up to $100,000. These plans are helpful but you need to shell out a setup charge of $149 plus interest and penalties till you fully pay your balance.

Compromise Offer

Try the offer in compromise if you face a struggle in paying your whole tax bill. To grant a compromise offer, IRS agents will consider elements like your assets, income, expenses and capability to pay. For more information, read the offer in compromise details on the IRS website. You may also utilize the online pre-qualifier for this plan to affirm your eligibility and craft your initial proposal.

Other Options

Other tax relief options are interest abatement or penalty relief and personal loan. Analyze your situation and select a suitable one from the available tax relief services.