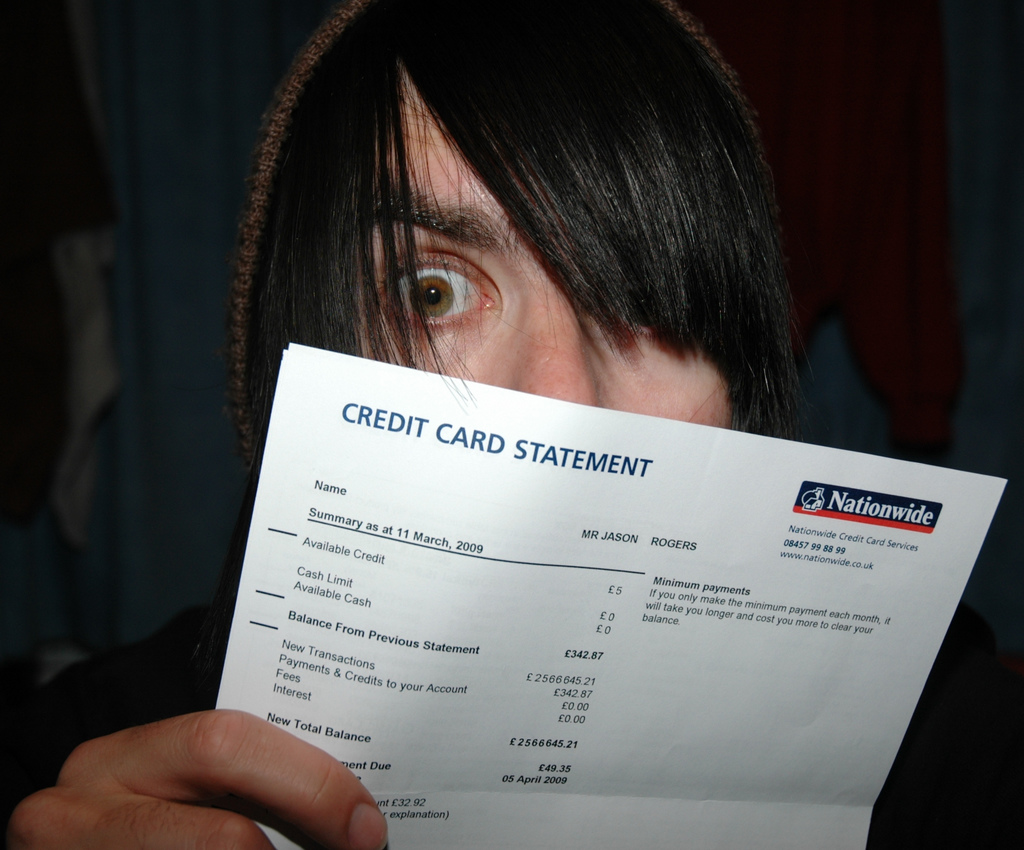

Are you struggling to keep your head above water? Has your financial picture gotten so murky that it’s hard to keep up with your monthly credit card payments?

If so, it is possible to solve your credit card issues once and for all. But occasionally our debt issues are so big that it’s practically impossible to handle them by making monthly payments regularly. You’re just suffering from a financial hardship that makes it impossible to make this happen.

If that’s the case, you’re going to have to begin seeking debt relief. Through debt relief, you’ll be able to come up with an alternative payment plan that will allow you to easily manage your debt better while making it possible to pay off your loans and credit cards.

According to Debtsettlement.co, a website discussing how to settle on a lower payment, “The purpose of debt settlement is to provide you with financial relief to help you make payments.”

Ultimately, the main goal is to prevent damaging your credit as much as possible. So coming up with a plan of this nature is certainly a bright idea.

Let’s take a look at your credit card debt relief options in full detail below.

Option #1: Negotiating Your Interest Rates

With this option, you’ll have a much easier chance at experiencing credit card debt relief. It’s effective because it’s something that you could potentially do on your own by calling your credit card company and asking them to lower your interest rate.

By paying a lower APR, you’ll have two potential ways that you can attack your debt.

You can continue paying the minimum payment, which will be a lot lower now that you’re paying a lower interest rate. Or you can continue making the same previous payment, and with a lower interest rate you’ll actually start paying down more of the principal balance every month.

Either way, lowering your interest rate through negotiating with your credit card company is definitely a great way to experience credit card debt relief sooner rather than later.

Option #2: Consider a Credit Card Balance Transfer

A credit card balance transfer is a viable option that you could also handle on your own.

With this method, you are going to take all of the balances from your existing credit cards and transfer them to a new card. By doing this, you’ll eliminate having so many existing cards and consolidate it into one.

During the consolidation process, this is also a valuable option because many of these new cards typically provide a 0% APR introductory range. It could last anywhere from six months up to two years.

In all honesty, you should try to find one with the longest 0% APR rate possible. This way you’ll be able to pay your bill every month and knock down the principal balance to lower your overall debt.

Option #3: Debt Settlement

Debt settlement is the final option that we are going to mention today, although there are other potential methods for credit card debt relief.

With debt settlement, you’ll find yourself in serious financial trouble and you’re trying to avoid filing for bankruptcy. Instead, you’ll either attempt this on your own or hire a professional to help you with this issue.

Generally speaking, you will contact each and every one of your creditors to see if you can pay a lump sum payment to eliminate your total debt. And you are going to attempt to get them to lower the amount that you owe to make it more affordable.

In truth, you’re better off hiring a company to help you with debt settlement. They know how to negotiate with credit card companies because they do this for a living.

Conclusion

Please use these credit card debt relief options to finally get yourself out of debt once and for all.